You are here

APU AKPK Club Hosts Dual Financial Empowerment Affairs at Sasana Kijang, Bank Negara Malaysia

Participants in the SIFU Dialogue and Innovative Finance Summit 2023 (IFS23) explored knowledge-sharing and ground-breaking strategies that address systemic financial issues — through a high-profile line-up of speakers covering a broad spectrum of financial topics.

Finance industry leaders and enthusiasts recently gathered at Sasana Kijang, Bank Negara Malaysia (BNM) for a dual event extravaganza: SIFU Dialogue 1.0 and Innovative Finance Summit 2023 (IFS23).

The Asia Pacific University of Technology and Innovation (APU) AKPK Club organised the events to promote financial inclusion, leveraging private capital for social and environmental benefit, and addressing systemic financial issues intelligently and uniquely manner.

The morning began with the SIFU Dialogue 1.0 — a knowledge-sharing forum within the finance sector that brings together seasoned financial experts and novices alike, fostering dialogue and mentorship.

Featuring a remarkable array of speakers who discussed a broad spectrum of financial topics, beginning with ‘Understanding How Finance Can Contribute to Achieving the United Nations Sustainable Development Goals (SDGs)’.

| |

Ms. Divyaasiny R Rajaghantham, Senior Analyst in Sustainable Finance from WWF Malaysia, and Ms. Joyline Chai, Vice President from ESG Association of Malaysia, shared their insights, moderated by Ms. Nur Lalua Rashidah Mohd. Rahsiad, Lead Sustainable & Inclusive Finance from APU.

It was followed by Dr. Yusuf Babatunde Adeneye, Senior Lecturer from Universiti Malaysia Kelantan (UMK), who presented a paper discussion session on ‘Carbon Risk and Access to Finance’.

To bring the SIFU dialogue 1.0 to an end, the Banking and Finance students of APU presented their posters on how the banking sector helps in achieving Sustainable Development Goals (SDGs).

Kenneth Jonathan Mardiyo was awarded the best poster presentation by a unanimous decision by the judges for his presentation.

As the day progressed, the momentum continued into the afternoon session where participants explored the ground-breaking strategies through the Innovative Finance Summit 2023 (IFS23).

This summit, known for its forward-thinking approach, brought together visionaries and innovators in the finance industry to explore ground-breaking strategies for innovative financial development.

| |

Panel discussions and sharing sessions were conducted, covering topics such as:

- Alternative Finance for Sustainable and Inclusive Finance by Elain Lockman, CEO and Co-Founder of ATA Plus Sdn. Bhd.

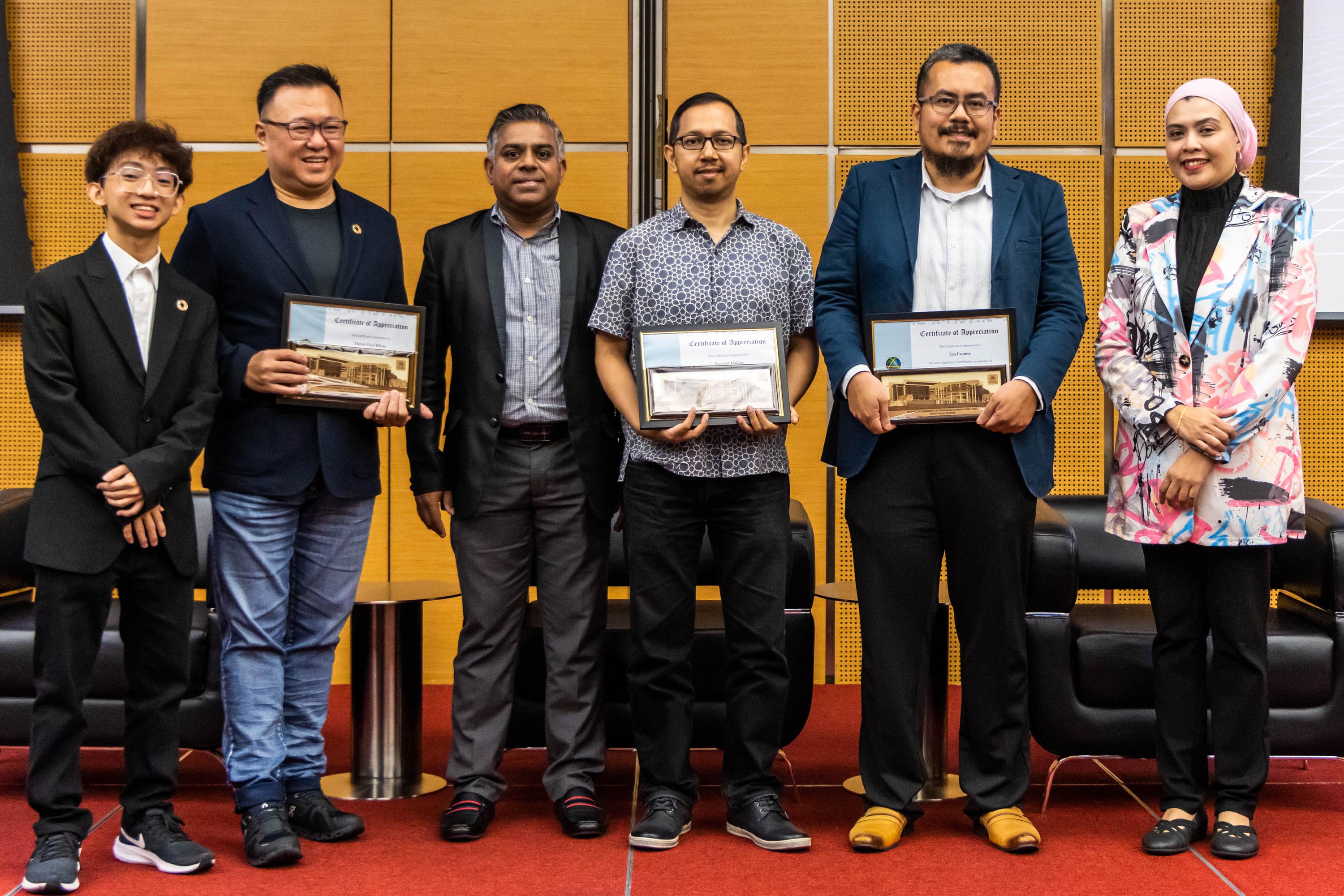

- A fire chat session on the topic of Digital Financial inclusion by Datuk Paul Khoo, Group MD & Co-Founder of ReGov Technologies Sdn. Bhd. (ReGov), and Mr. Nazroof Hakim, Chief Executive Officer of Billplz.

- Digital Investment Issues by Mr. Eza Ezamie, Chief Executive Officer of Laughing Tree Sdn. Bhd.

A shared goal, addressing systemic financial risks

Both events shared a common goal to proactively address systemic financial risks and vulnerabilities in the global economy.

The discussions provided a platform for experts to share insights on risk management strategies, regulatory frameworks, and collaborative approaches to ensure a resilient and sustainable financial ecosystem.

The guest list for both events included high-profile representatives from leading companies such as ACS Digital Berhad., the Securities Industry Development Corporation (SIDC), and the International Financial Literacy Certified Institute.

These industry giants contributed to the dynamic discussions, providing unique perspectives on how to navigate the innovative financial landscape and address the challenges and opportunities presented by emerging trends.

Participants from other higher institutions such as City University, UCSI University (UCSI), Universiti Malaya (UM), Universiti Sains Islam Malaysia (USIM), Management & Science University (MSU), and the International Center for Education in Islamic Finance (INCEIF) University also joined the discussions.

Prof. Ir. Eur. Ing. Ts. Dr. Vinesh Thiruchelvam, APU Chief Innovation & Enterprise Officer, gave the opening welcome speech for both sessions, stating that the events held at Sasana Kijang were nostalgic because APU first began working with BNM via its museum in collaboration to develop holograms for the museum.

| |

These two events have been excellently driven by industry, with strong support from the AKPK student club, led by Ms. Lalua Rashid.

The dual-event extravaganza at Sasana Kijang, BNM, not only highlighted the dynamism of the finance industry but also emphasized the sector’s crucial role in shaping a more inclusive and sustainable future.